How to Turn Procurement into a Profit Center for Your Business

Three years ago, I wrote in "The Technology Procurement Handbook":

My message was that the procurement strategy must transform to align with Industry 4.0 requirements or be dissolved by cost-cutting and new technologies.

It still sounds right, but practical advice is needed to achieve such a transformation.

So, here it is: procurement must become the profit center.

Notably, a profit center is a cost center but not vice versa.

The following article elegantly explains important distinctions that matter to people employed there.

Your company will invest in your growth as long as you earn and create. If you comply and obey, be prepared to ride the wave of technological changes or an inevitable right-sizing campaign.

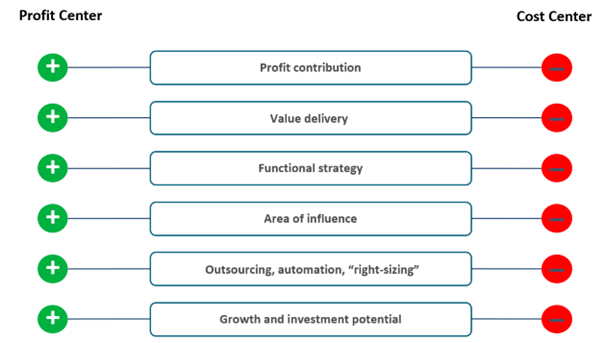

Below is a summary of the crucial differences between the two types of centers.

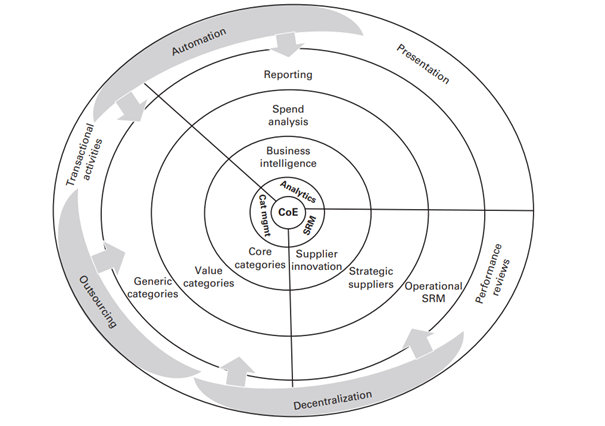

"Three horsemen of Apocalypse – decentralization, automation, and outsourcing – entered the realms of procurement and conquered the transactional and presentation layer. They're further aiming at category management, reporting, and operational SRM; the closer you're to the center, the safer your job is."

My message was that the procurement strategy must transform to align with Industry 4.0 requirements or be dissolved by cost-cutting and new technologies.

It still sounds right, but practical advice is needed to achieve such a transformation.

So, here it is: procurement must become the profit center.

Profit center vs. cost center

I needn't explain the differences between these two centers—the names say it all. Some earn money to spend, and some spend other people's revenues.Notably, a profit center is a cost center but not vice versa.

The following article elegantly explains important distinctions that matter to people employed there.

Your company will invest in your growth as long as you earn and create. If you comply and obey, be prepared to ride the wave of technological changes or an inevitable right-sizing campaign.

Below is a summary of the crucial differences between the two types of centers.

When I worked on it, I suddenly realized why many procurement departments need more functional strategies or ambition to develop it.

They're still comfortable being a cost center and protecting their glebe, which can be done without strategizing.

Case studies on profit-centered procurement

Unilever's Strategic Supplier Collaboration

Unilever aimed to boost profitability through enhanced supplier collaboration and innovation.

They shifted from traditional cost-cutting procurement to value creation, co-innovating with suppliers to develop sustainable products.

This approach led to a 15% reduction in costs and a significant increase in market share, demonstrating how procurement can drive profit through strategic partnerships.

This approach led to a 15% reduction in costs and a significant increase in market share, demonstrating how procurement can drive profit through strategic partnerships.

Apple's Supplier Investment Strategy

Apple is known for investing in its supply chain and treating suppliers as partners rather than cost centers.

Apple strategically invests in suppliers, providing them with capital and technical assistance. This ensures high-quality production while maintaining long-term profitability.

This model has led to the development of exclusive supplier relationships and a highly efficient, profitable supply chain that supports Apple's premium pricing strategy.

Apple strategically invests in suppliers, providing them with capital and technical assistance. This ensures high-quality production while maintaining long-term profitability.

This model has led to the development of exclusive supplier relationships and a highly efficient, profitable supply chain that supports Apple's premium pricing strategy.

Dell revolutionized the PC industry with its direct-to-consumer model, heavily reliant on a responsive and cost-effective procurement strategy.

By bypassing intermediaries and optimizing just-in-time procurement, Dell reduced inventory costs and improved cash flow, directly enhancing profitability.

The approach led to higher margins and profitability while maintaining competitive pricing.

In this post, we described many ways procurement generates income, such as reciprocal buying, subleases, co-marketing, revenue share, and the sale of obsolete assets.

In addition, we should develop a functional strategy that is deeply integrated with the corporate one. Then, we should stop measuring ourselves by the outcome of sourcing efforts (efficiency) but by the success of strategy execution (effectiveness.)

Our KPIs must demonstrate the procurement contribution to the critical business metrics—not just COGS but profit margins. Further, we may show the improvement in the time-to-market cycle, employee satisfaction resulting in improved retention, inventory turnover, etc.

Procurement savings must reflect upon budgets. We'd instead commit to 2-3% price erosion upfront than get shaking the purse with 10+ percent later, which makes no one better off.

Our area of influence should be wide enough to enable the deep search for efficiencies and innovations.

Easier said than done, but it still looks achievable.

To keep receiving new insights and research, please subscribe here.

By bypassing intermediaries and optimizing just-in-time procurement, Dell reduced inventory costs and improved cash flow, directly enhancing profitability.

The approach led to higher margins and profitability while maintaining competitive pricing.

Strategies for income creation through procurement

Logically, to become a profit center, procurement performance must reflect on the company's bottom line.

In this post, we described many ways procurement generates income, such as reciprocal buying, subleases, co-marketing, revenue share, and the sale of obsolete assets.

In addition, we should develop a functional strategy that is deeply integrated with the corporate one. Then, we should stop measuring ourselves by the outcome of sourcing efforts (efficiency) but by the success of strategy execution (effectiveness.)

Our KPIs must demonstrate the procurement contribution to the critical business metrics—not just COGS but profit margins. Further, we may show the improvement in the time-to-market cycle, employee satisfaction resulting in improved retention, inventory turnover, etc.

Procurement savings must reflect upon budgets. We'd instead commit to 2-3% price erosion upfront than get shaking the purse with 10+ percent later, which makes no one better off.

Our area of influence should be wide enough to enable the deep search for efficiencies and innovations.

Easier said than done, but it still looks achievable.

P.S. If you appreciate hundreds of hours invested in researching and writing this blog, you can buy me a coffee or subscribe for the membership by following this link. Thank you!

More information on this and other exciting topics can be found in "The Technology Procurement Handbook." It represents 23 years of experience, billions of dollars worth of successful sourcing projects, and 1000s of hours spent on research, analysis, and content creation for the most demanding professional readers.

Comments

Post a Comment